As an entrepreneur, starting a business is an exciting venture. Among the various business structures, sole proprietorship stands out for its simplicity and ease of establishment. However, it is essential to be aware of the potential drawbacks of this structure before making a decision.

Image: www.chegg.com

Disadvantages of Sole Proprietorship

Lack of Separate Legal Entity

A primary disadvantage of sole proprietorship is the lack of a separate legal entity. In this structure, the owner and the business are one and the same. As a result, the owner is personally liable for all business debts and obligations. If the business faces legal issues or financial difficulties, the owner’s personal assets, such as their home and savings, are at risk.

Limited Liability Protection

In contrast, corporations and limited liability companies (LLCs) provide liability protection to their owners. This means that the owners’ personal assets are generally shielded from business debts and liabilities. Sole proprietorships, on the other hand, do not offer this level of protection, leaving the owner exposed to significant financial risks.

Image: www.easylegalman.com

Taxation

Sole proprietorships are subject to self-employment taxes, which include Social Security and Medicare contributions. Additionally, business income is reported on the owner’s personal income tax return and taxed at their individual rate. The tax burden can be higher for sole proprietors compared to owners of incorporated businesses, who typically enjoy lower tax rates and deductions.

Lack of Capital

Access to capital can be a challenge for sole proprietors. Since the business is not a separate entity, it cannot issue stock or raise funds from investors. Additionally, sole proprietors often rely on personal savings or loans to finance their businesses, which can limit their ability to grow and expand.

Difficulty in Raising Money

Obtaining loans and other forms of financing can be more challenging for sole proprietors. Lenders may be less likely to extend credit to individuals who are personally liable for business debts. As a result, sole proprietors may face higher interest rates and stricter qualification requirements compared to owners of incorporated businesses.

Tips and expert advice for overcoming the disadvantages:

- Consider forming an LLC:

Forming a limited liability company can provide legal protection and liability shield that a sole proprietorship won’t offer.

- Seek legal advice:</

Consulting an attorney can help you understand the legal implications of your business structure and advise on ways to mitigate risks.

- Increase the ability to raise capital:

Explore alternative funding options such as crowdfunding, angel investors, or partnering with other businesses.

- Build strong relationships with lenders:

Establish a solid track record by making timely payments and maintaining good financial management.

- Prepare a professional business plan:

When seeking financing or investment, having a well-written business plan will greatly increase your chances of securing support.

FAQ on Sole Proprietorship Disadvantages

Q: Can sole proprietors avoid personal liability?

No, sole proprietors are personally liable for all business debts and obligations.

Q: What are the tax implications of sole proprietorship?

Business income is reported on the owner’s personal income tax return and taxed at their individual rate, and they are subject to self-employment taxes.

Q: Can sole proprietors form a business partnership?

Yes, sole proprietors can form a partnership with other individuals, but each partner remains personally liable for business obligations.

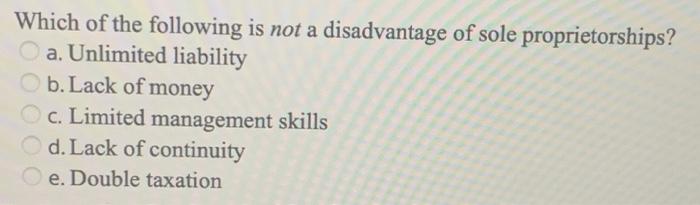

Which Of The Following Is A Disadvantage Of Sole Proprietorship

Conclusion

While sole proprietorship offers simplicity and ease of establishment, it is crucial to comprehend its potential drawbacks. The lack of liability protection, limited capital access, and taxation considerations can impact your business operations and personal assets. By weighing the advantages and disadvantages, and considering alternative business structures, aspiring entrepreneurs can make informed decisions that best align with their business goals and risk tolerance.

Are you interested in the sole proprietorship topic? Let us know in the comments below!